Deemed ‘Essential,’ Colorado Cannabis Companies Face COVID-19 Fallout Without Federal Small-Business Lifelines

It’s an unprecedented industry that’s known nothing but unprecedented times — yet the coronavirus and its economic impact feels like nothing the cannabis sector has ever seen before.

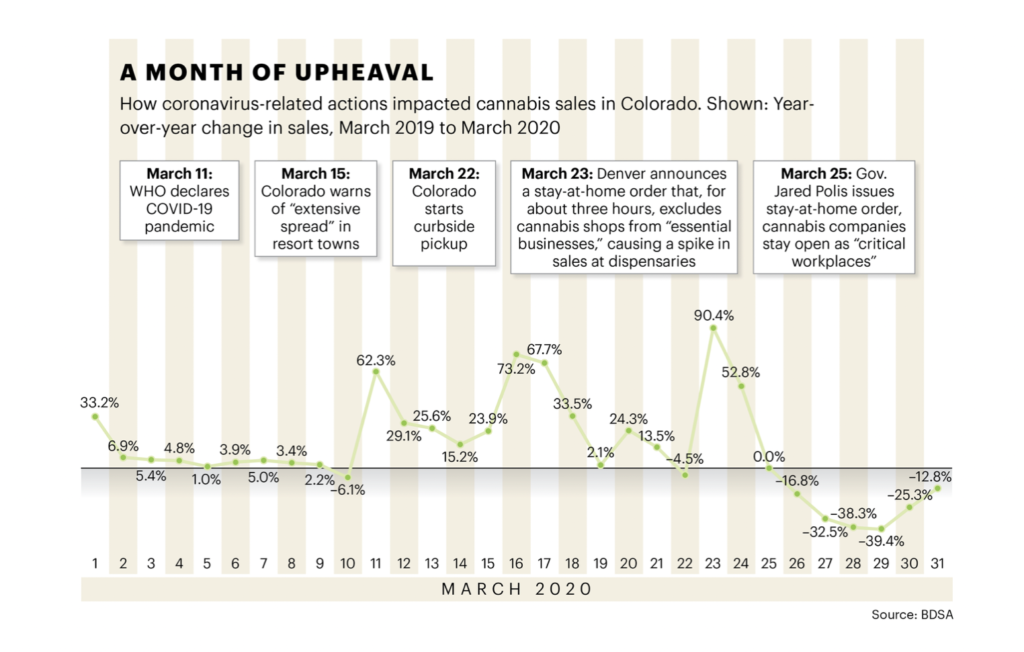

While witnessing bars, restaurants and retail outlets close up shop across the metro in the face of stay-at-home orders and economic fears surrounding the coronavirus pandemic, cannabis businesses have also seen initially soaring sales come back to earth; been whiplashed by a rapidly shifting regulatory environment; and continued their work knowing that they’ve been explicitly excluded from the U.S. Small Business Administration’s disaster loans that many other businesses will rely on as a lifeline.

But at the same time, this pandemic is opening up new opportunities for these companies, and even donning them with increased legitimacy — something these organizations have been pursuing for decades, but especially since the 2012 passage of Amendment 64, which legalized recreational sales of the plant in Colorado.

“They say cannabis and alcohol are recession-proof. This is not a recession,” Dan Anglin, founder and CEO of Denver-based edibles brand CannAmerica, told Denver Business Journal. “I don’t know what this is. I’ve been on this planet for half a century and I’ve never seen anything like this. It’s getting weirder every day. Who can project what’s going on?”

Just the Essentials

Six years ago, when Amendment 64 went into effect, it would have been hard to imagine that the companies selling weed to anybody over the age of 21 who wanted it would someday be deemed “essential” by authorities.

Yet on March 22, Gov. Jared Polis declared medical cannabis dispensaries “critical workplaces” — a move that allowed them to stay open like grocery stores and pharmacies. The order was soon expanded to cover recreational shops.

Then came an about-face from the City of Denver after an initial stay-at-home order didn’t include cannabis retailers, resulting in mass panic buying. Cannabis stores that practice “extreme social distancing” are now deemed “critical,” according to Mayor Michael Hancock’s amended order.

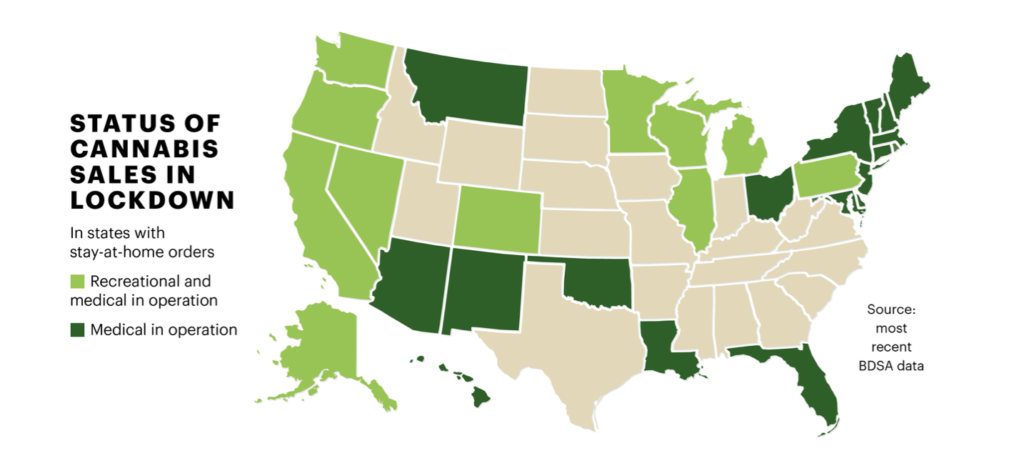

And it’s not just in Colorado. Across the nation, states with legalized cannabis programs are deciding that their citizens have the same right to cannabis as they do Big Macs and Tylenol. An analysis by trade publication MJBizDaily shows that “most state governments around the nation [that have implemented legal marijuana programs as well as stay-at-home orders] have deemed medical marijuana companies ‘essential.’”

“Cannabis has been essential to many people for a long time and now that’s being acknowledged by governments across the country. It’s a positive social change and Coloradans have been on the forefront of what’s right.” Jordan Wellington, vice president of government affairs at cannabis consulting group VS Strategies, told DBJ.

There’s a growing consensus within the industry that government is realizing even marijuana users without medical cards are often using the plant for medical reasons.

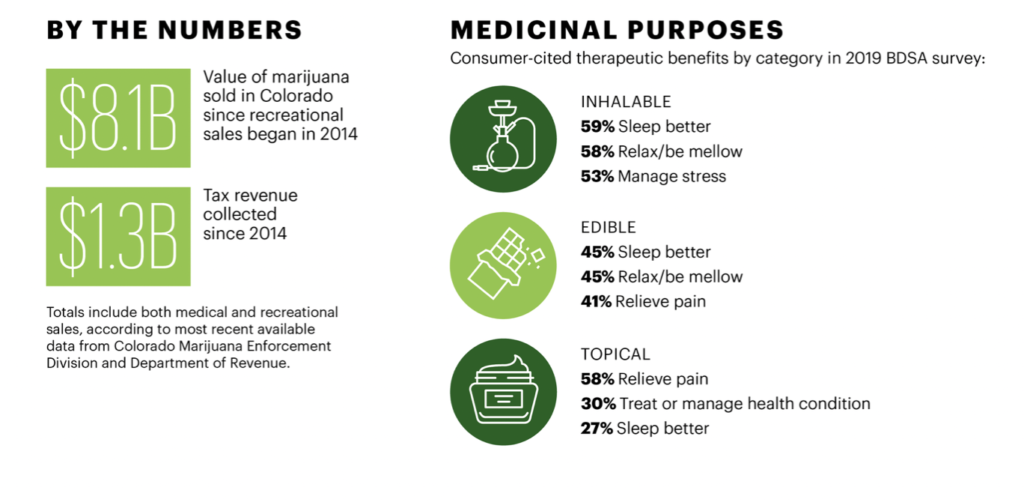

Consumer research by Boulder business intelligence firm BDSA, formerly BDS Analytics, shows that a majority of cannabis consumers use the plant for “health and wellness” purposes, many of which could be considered medical.

59% of consumers who report smoking or vaping marijuana say they do so to “sleep better,” and 41% of edibles consumers report they do so to “relieve pain” in the 2019 survey.

The economic clout of the state’s cannabis companies, and the associated tax revenue, is another factor. As of February the state had sold $8.1 billion worth of marijuana since adult-use, or recreational, became legal in 2014, raking in over $1 billion in tax revenue.

“How remarkable is it that it’s gone from being [illegal] to being classified as an essential business? I think that that’s a permanent shift — I don’t think you go back to saying that it’s a bad thing,” Nancy Whiteman, CEO of Boulder edibles manufacturer Wana Brands, told DBJ.

But the move to essential status isn’t without its critics. Marty Otanez, associate professor at University of Colorado Denver’s Department of Anthropology, studies labor issues within the cannabis industry.

“With cannabis companies classified as ‘essential services’ during COVID-19 in Colorado, cannabis workers are increasingly vulnerable due to limited or inadequate protective masks and unsafe physical distancing in workplaces,” Otanez said. “… A related issue is how workers may feel torn about providing medicinal and recreational cannabis to consumers and patients while taking away PPE from health-care workers facing shortages of protective masks and other PPE.”

Regulatory ‘Whiplash’

In the past month, the cannabis industry’s storefronts have gone from establishments with strict security protocols and transactions mandated to be done behind locked doors to stores being required to drop their product off “curbside” to their customers (sometimes involving outdoor cash transactions) and, now, businesses that have the option of doing either.

“It’s regulatory whiplash,” Jill Lamoureux, co-founder of Boulder dispensary The Republic, told DBJ.

Her store, which opened in February, had to navigate unexpected red tape within weeks of launching as the coronavirus began to spread. The MED established emergency rules on March 22 that required adult-use storefronts to convert to online ordering and curbside pickup for social-distancing purposes. Within a week, the MED laid out new rules that gave stores the option of in-store sales, but banned outdoor cash transactions.

“We’ve worked hard to make sure the guidance and emergency rules we’ve issued are responsive to the feedback we get from our stakeholders,” MED Deputy Director of Policy, Licensing and Communications Dominique Mendiola told DBJ. “We’re also coordinating closely with our local partners to ensure timely communication and a collaborative approach to problem solving.”

The Republic’s parking lot is home to a sign that’s been painted over four times as the dispensary has tried to stay on top of the changing regulatory climate. For now, Lamoureux said, all of her sales are through preorders. Customers receive a text message when their order is ready, and they call when they’ve arrived. No more than two people at a time are allowed into the dispensary to ensure extreme social distancing.

Still, she said, sales are up — even after the initial coronavirus surge that saw Colorado dispensary sales jump 140% one Monday alone after Mayor Hancock’s order spooked consumers, according to Denver-based cannabis tech firm Flowhub.

“But it’s hard to tell what’s natural growth because we’re a new store,” Lamoureux cautioned.

Other companies have reported dramatically lower sales after that initial boost.

“We were up about 100% in sales for the first few weeks prior to the [shelter-in-place order],” dispensary chain Euflora’s founder and CEO Pepe Breton told DBJ. “I think the next two, three weeks, we’ll be down 80% overall.”

Wana Brands’ Whiteman said her company initially saw “a huge stocking-up week followed by a couple relatively normal weeks,” before a slower week of March 30.

“I think it’s a couple of things,” Whiteman said. “First of all, I think that dispensaries are trying to adjust to the changing policies. Two weeks ago, they were all scrambling to adjust to curbside pickup and online ordering. For dispensaries smack in the middle of the city, that’s very hard to pull off. For a lot of stores, curbside wasn’t practical.”

A Cry For Help

While other businesses in the region are suffering, they also have access to a lifeline in the form of SBA loans through federal stimulus packages like the $349 billion Coronavirus Aid, Relief, and Economic Security Act and $2.2 trillion Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020.

But due to federal cannabis prohibition, companies that directly work with the plant — and some businesses that provide services to them — are cut off from that lifeline. They’re not even qualified for federal bankruptcy protections.

LivWell Enlightened Health, which runs 18 retail outlets in the state — nine of those stores in the Denver area — told DBJ it’s deferring all executive compensation for 90 days in order to avoid layoffs of its frontline staff.

Ashley Picillo, founder and CEO of cannabis management consulting firm Point Seven Group, told DBJ that her company, which employs 14 people serving 70 worldwide markets, has applied for two loans through the Paycheck Protection Program, which is part of the CARES Act, and meant to cover salaries, mortgage payments, health-care coverage and other employment costs. The first was denied.

“We’re being cautioned that we might not expect to get these loans because of our standing in the space,” Picillo said. “It’s really frustrating because the industry’s getting cut off at its knees in a lot of ways.”

She said she’s concerned about her company’s near-term future.

“It’s affecting all cannabis companies in the supply chain, whether you’re license-holding or not,” Picillo said. “If they’re not able to access some of these loans and other programs, they won’t be here in a few weeks or a few months.”

CannAmerica’s Anglin echoed other industry leaders when he said he hopes Colorado and others will implement state programs to act as a buffer.

“I think that it’s important for Gov. Polis and all the other governors who have supported and identified that cannabis is essential to start considering how they can offer some kind of support for their businesses.”

A spokesperson for Polis, who has written a letter to Congress requesting cannabis companies be included in future federal relief, told DBJ that the cannabis industry “is an important part of our state’s economy,” and that Colorado will “continue to evaluate the ways in which the state can support this industry along with so many others during this difficult time.”

And Colorado’s economic development office is in the early stages of looking at how to assist these companies that are cut off from federal help, according to the Colorado Office of Economic Development and International Trade.

“While the federal economic relief programs available in the CARES Act are unprecedented in size and reach, we recognize that gaps remain. The cannabis industry does not currently qualify for federal economic support so we are examining how to assist the industry during this economic interruption and as normalization policies are considered throughout Colorado,” OEDIT Executive Director Betsy Markey told DBJ.

One potential bright spot for these businesses is the federal government’s deadline extension of tax payments until July 15. For cannabis companies, which can pay as much as 90% effective tax rates due to a federal tax code called 280E, this could be much needed relief and, in a way, a silver lining.

“It’s a three-month interest-free loan,” Hall Estill tax attorney and shareholder Jennifer Benda told DBJ. “For once, [cannabis companies are] not treated differently.”

Next Stop: Delivery?

While the state Legislature legalized delivery of medical cannabis in 2019, effective this year, and adult-use beginning in 2021, each municipality must individually authorize it to make it a reality. And three months into the year, only two jurisdictions have moved forward: Boulder and the neighboring Superior.

Native Roots, the region’s second-largest cannabis company when ranked by number of employees, showed impeccable timing when it announced it had landed the first delivery permit in the state on March 19, and would begin delivering to those two cities.

And other companies are pushing to expand delivery options for more Coloradans, especially those most at risk of COVID-19’s complications.

“These are solutions we need for this crisis immediately,” Amy Sharp, founder of Sharp Solutions, told DBJ. Her company currently offers business-to-business cannabis delivery, and is lobbying more municipalities to go the way of Boulder.

“Going the extra mile was our initial intent before the coronavirus, and Amy’s been a big advocate for it,” Sharp Solutions Director of Communications Colton Keluche told DBJ in the same conversation. He explained that cannabis helps many consumers with inflammation, arthritis and joint pain, all of which can make movement nearly impossible. Many medical patients are also immunosuppressed, making them more susceptible to coronavirus complications.

The two markets on which they’re most focused are Colorado Springs and Longmont.

Northglenn City Council member Randall Peterson researched the issue and concluded that delivery could benefit his community. He proposed an ordinance to his City Council colleagues on March 19 that would have authorized medical marijuana delivery. The proposed ordinance was gently shot down.

“I favor this, but it’s just not a real priority right now from the citizens,” Peterson told DBJ after the meeting. “However, many people on Council are open to more exploration of the idea so it’s not dead — but it’s also not ripe.”

And in Denver, which has historically led the way in cannabis rules, the city is referring sick patients to the state’s caregivers program, which allows a designated person to grow marijuana for patients and transport the plant for those who are homebound.

“Fortunately, there is a program in Colorado for medical marijuana patients that eliminates the urgent need for a delivery program during this crisis,” Denver Excise and Licenses Director of Communications Eric Escudero told DBJ. “… Denver is continuing to evaluate whether to opt in or opt out to medical marijuana delivery in the future, while making sure we consider social equity in any new marijuana licenses potentially issued so there is equitable access to the industry.”

Rethinking Expansion

2020 was supposed to be a high time for cannabis companies. House Bill 1090 passed in 2019, allowing outside investment into these previously sealed-off businesses. Expansions were being announced and companies were being bought.

But the dark clouds hovering over the national economy — and the existing uncertainty caused by the recent pot-bubble burst — have caused some Colorado cannabis companies to retool those out-of-state expansion plans.

Euflora opened its first retail location outside of Colorado in California 2019. It owns licenses in Massachusetts and planned to open four new locations in Oklahoma in April to coincide with the famed 420 stoner holiday, but has pushed those plans back to at least summer.

“Coronavirus has impacted us in every different state, from the retail level to the local-government level to the state being shut down,” Breton said.

Breton spoke to DBJ from Miami, where he was exploring the purchase of a license to operate cannabis facilities in Florida — something he says comes with a $50 million price tag.

In early March, as the Dow was hitting records and dropping 2,000 points on coronavirus fears, Breton received bad news.

“My investor called me, and he’s like, ‘Hey, I literally just lost half the money I was going to invest with you in the market,’” Breton said.

Luckily, he explained, he had a few other investors and he’s on track to secure the license.

Denver-based concentrate manufacturer Spherex, meanwhile, is also moving ahead with plans to enter Oklahoma, but the timeline has shifted and the rollout rethought.

“We may have a little bit of a delay in Oklahoma … but we are continuing to press forward,” Spherex Partner and Chief Financial Officer Dan Gardenswartz told DBJ.

The company is reworking its promotional campaigns so as to hit the right tone and prevent crowds. In-person product-launch parties have gone virtual, and Spherex is having lunches delivered for the staff at dispensaries where it’s rolling out its product.

All in all, though, the company has a sunny outlook on the move.

“We’re cautiously optimistic, and the only reason I say ‘cautiously’ is because every day brings something new with this crisis,” Gardenswartz said. “We’re continuing to do what we have to do.”

Impact on 420

This year was supposed to be special for the cannabis industry in another way. In the year 2020, the entire month of April is “420.”

Euflora, which holds the license for the giant FlyHi 420 Festival held in Denver’s Civic Center Park each year, had to cancel its event due to coronavirus. It had already booked hip-hop artist Lil Jon, and lost a nonrefundable $50,000 deposit, though that could possibly be used toward a future appearance, Breton told DBJ.

That pales in comparison to the $250,000 the dispensary chain says it’s been losing each year by throwing the event since it landed the license in 2018.

“We just kind of eat it and take it off as a marketing expense,” Breton said. Now that his company has held the license for three years without any major issues, he says he’s “grandfathered” in for another decade of throwing the festival, which draws thousands of attendees each year.

“Hopefully in the next 10 years, once this becomes federally legal, we can get bigger sponsors and bigger names,” he said.

And while Euflora is canceling its event altogether, other cannabis companies are going remote for the holiday.

CannAmerica Brands has launched an online series celebrating “The Spirit of 420” in lieu of in-person events and Spherex is sponsoring virtual 420 celebrations in Colorado and California, including at local dispensaries Lightshade, The Farm and Terrapin Care Station.

“I don’t have any bands lined up; I don’t have any celebrities lined up,” Anglin said. “We’re probably going to try and get some kind of forum where cannabis consumers and people in the industry can join in a virtual 420 and talk about their cannabis story. … We’re trying to work it out.”

How Can Point Seven Group Help?

The team of cannabis consultants and professionals at Point Seven Group have worked extensively in the U.S. and international cannabis markets and are familiar with the unique challenges of the cannabis industry. Follow us on social media to stay up to date with more cannabis industry updates!

- Wayzata moves to open city-run weed dispensary

The City of Wayzata is considering opening its own recreational cannabis dispensary sometime next year. On Tuesday, Wayzata’s City Council and mayor approved a contract with Colorado-based consulting firm Point7 to draft a business plan for the possible municipal dispensary. This would be the city’s …

The City of Wayzata is considering opening its own recreational cannabis dispensary sometime next year. On Tuesday, Wayzata’s City Council and mayor approved a contract with Colorado-based consulting firm Point7 to draft a business plan for the possible municipal dispensary. This would be the city’s … - Indiana Cannabis Legalization: 2024 Update

The Midwest has become a bustling hub for cannabis policy and industry, with states like Michigan, Illinois, and Ohio leading the charge in cannabis legalization. However, Indiana’s stance on cannabis remains a topic of significant interest and debate. As we delve into the status of …

The Midwest has become a bustling hub for cannabis policy and industry, with states like Michigan, Illinois, and Ohio leading the charge in cannabis legalization. However, Indiana’s stance on cannabis remains a topic of significant interest and debate. As we delve into the status of … - Cannabis Expungement and Social Equity: Proven & Failed Concepts

In the realm of cannabis expungement and social equity, examining both proven and failed concepts is crucial for understanding the complexities of justice reform and equity within the cannabis industry. Proven concepts include initiatives such as automatic expungement processes, which streamline the clearance of certain …

In the realm of cannabis expungement and social equity, examining both proven and failed concepts is crucial for understanding the complexities of justice reform and equity within the cannabis industry. Proven concepts include initiatives such as automatic expungement processes, which streamline the clearance of certain …